Thursday, 14 March, 2024

Saudi Arabia's VC boom: A golden mirage shimmers in the shifting sands

Dr Yahya Shakweh PhD CEng CDir. FIED FIoD

Saudi Arabia’s venture capital scene is experiencing a surge, akin to a shimmering mirage promising a lush oasis in the vast desert. Fueled by the ambitious goals of Vision 2030 and a youthful, tech-savvy population, this exciting new frontier presents a wealth of opportunities. But like any desert expedition, challenges await, demanding attention to ensure a sustainable journey.

Opportunities abound in the Kingdom

The winds of change are blowing strongly for Saudi VC. Here are the key forces propelling it forward:

Vision 2030’s Backing: The government’s plan prioritizes innovation and entrepreneurship, translating into increased funding, streamlined regulations (where possible), and initiatives fostering a supportive ecosystem for startups.

A Growing Market: A young population with a high digital adoption rate creates fertile ground for startups catering to the country’s evolving needs.

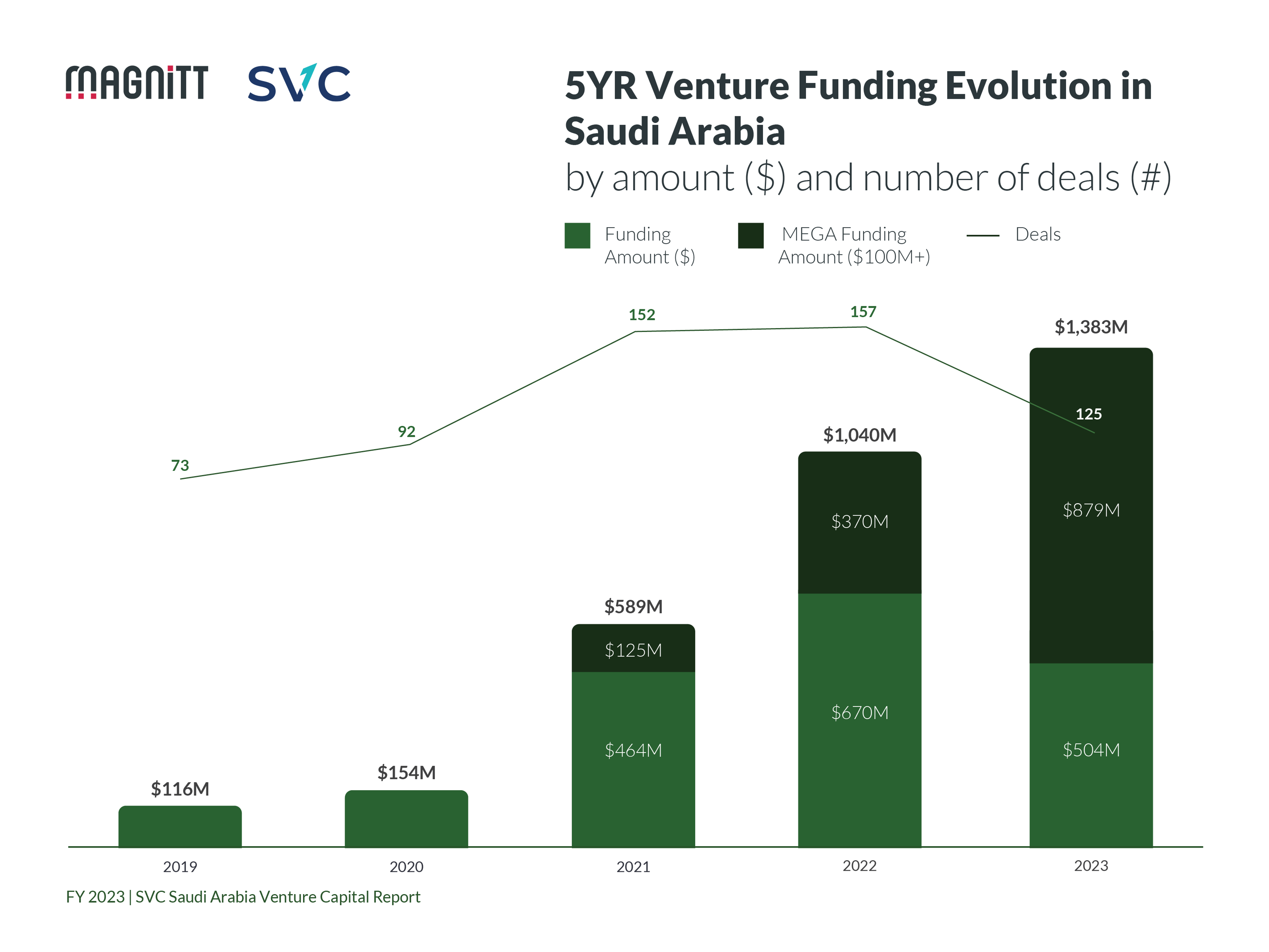

Untapped Potential: Compared to regional hubs, Saudi Arabia offers a largely uncharted territory brimming with promising investment prospects. Sectors like fintech, e-commerce, and renewable energy hold immense potential. For instance, STC Pay, a Saudi mobile wallet platform, has emerged as a major player in fintech, showcasing the kingdom’s potential for homegrown innovation. Data from MAGNiTT, a leading MENA startup data platform, reveals fintech as the top VC-funded sector in Saudi Arabia, attracting over $100 million in investments in 2023.

Despite that, there can sometimes be challenges - as there are with any entry to a new market. Data-driven analysis, understanding cultural nuances, establishing metrics for success and being alive to the challenges beyond bureaucracy can help you clear any hurdles.