Tuesday, 09 September, 2025

The keystone

New real estate law to revolutionise sector, attract FDI and accelerate Vision 2030

Shahad Alsubaie - Inside Saudi

Construction site at Diriyah, The City of Earth, the over $63 billion, 14 square kilometre giga-project on the outskirts of Riyadh, where 100,000 people will live and work

In a move that decisively signals a new era for global capital, Saudi Arabia has recently approved a landmark law regulating real estate ownership and investment by non-Saudis.

Effective January 2026, the new law will allow foreign individuals and entities whether residents or abroad to own and invest in real estate within specially designated zones across the Kingdom, replacing the current patchwork of exceptions and licences.

Although details of the regulations and enforcing provisions are yet to be published, government spokespeople have suggested that the zones will be in major urban centres, a logical next step in attracting foreign direct investment to boost supply and liquidity in the real estate market and ultimately, stimulating urban development as part of Vision 2030.

The proposals

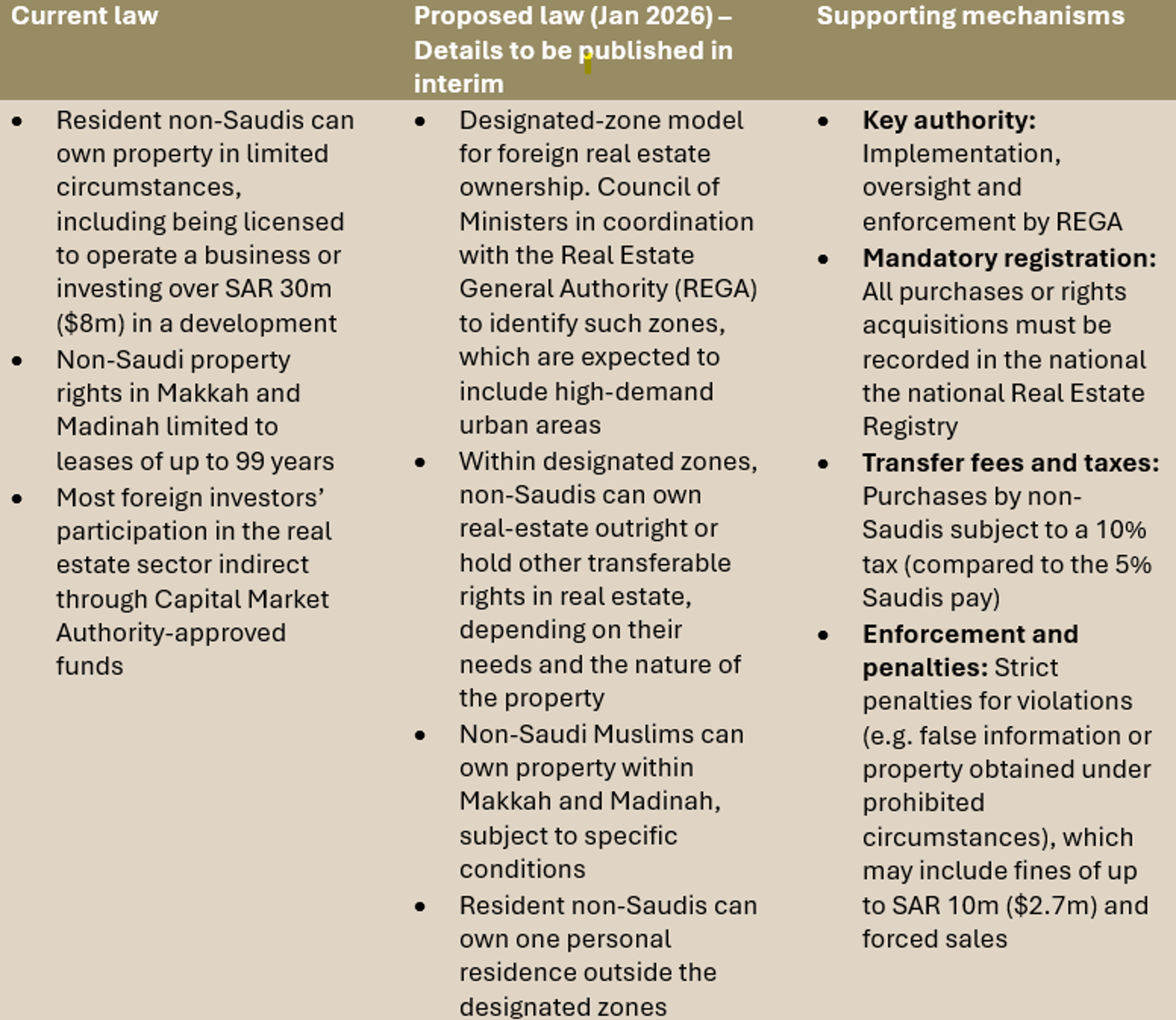

Whilst foreign property ownership is not new in the Kingdom, the rules around this have historically been very restrictive.

At present, a resident non-Saudi can own property only in very limited circumstances, such as being licensed to operate a business or investing more than SAR 30 million ($8 million) in a development project. The holy cities of Makkah and Madinah are entirely off-limits to non-Saudi ownership.

The one real pathway for foreign investors has been indirect – through Capital Market Authority-approved real estate investment funds. These allow participation in the sector, but not actual ownership or access to residential markets.

The new law marks a significant policy shift towards opening the real estate sector. Within the designated zones, which are expected to include major projects in the Kingdom and high-demand parts of major cities such as Riyadh and Jeddah, non-Saudi individuals, corporations, funds and non-profits will be able to own real estate outright, subject to a 10% tax (compared to the 5% that Saudis pay). Resident non-Saudis will also be able to own one personal residence outside the designated zones.

Other transferable rights in real estate that will be obtainable include long-term leaseholds, usufruct rights (the right to use and benefit from property), easements, and similar interests depending on investors’ needs and the nature of the property.

Reflecting their cultural and religious importance, the longstanding prohibitions on non-Saudis owning property in Makkah and Madinah will largely be maintained. However, the new law will allow Muslim foreign individuals and foreign-owned Saudi businesses to hold title in these cities, a departure from current arrangements which restrict non-Saudi rights in these cities to leaseholds.

A poll of 500 high net worth Muslims from around the world by YouGov and Knight Frank last year suggested high demand from international investors to buy real estate in Makkah and Madinah – with total potential investment from those surveyed of close of $2 billion.

The Real Estate General Authority (REGA) has been tasked with implementing the new law, issuing any related regulations or guidance, and establishing the legal and regulatory infrastructure of the property market in alignment with global best practices to boost its maturity and appeal to global investors.

To ensure that foreign ownership remains within economically and socially appropriate bounds for each area and property type – in particular, to avoid a real estate bubble and compromising housing access for Saudi citizens – the regulations are expected to include controls such as the ability for REGA to redesignate real estate investment zones to balance supply/demand and pricing, investment thresholds; and limitations on the nature, number, size and values of real estate acquired.

Accelerating the Kingdom’s economic transformation

The case for investing in Saudi Arabian real estate is clear. The Kingdom is in growth mode, the population is young (over 60% are under 30 years old) and rapidly growing with a high disposable income, and government policies are dedicated to increasing home ownership by Saudi households of 70% by 2030.

In a signal of growing international confidence in the unprecedented economic transformation led by Vision 2030, the International Monetary Fund (IMF) recently raised its forecast for the Kingdom’s GDP growth in 2025 to 3.5%, up from the previous estimate of 3.2%, pointing to the strength of non-oil sectors and the rapid progress of Vision 2030.

The new law will have a multiplier effect on key parts of the economy and will boost Vision 2030 Saudisation, net job growth, FDI and private-sector expansion targets.

Sectors that will immediately benefit include construction, banking (the mortgage market in particular), insurance (particularly homeowner and fire insurance), and home furnishings. Other beneficiaries will include property consultants, real estate brokerages, architects and legal services.

During 2024, the number of real estate transactions increased by 37% to almost 237,000, according to data collected by Knight Frank, and figures published by the Saudi Arabian Monetary Agency show a 20% per year growth in retail mortgage lending since 2020, double the rate of overall bank lending.

Saudi banks have capacity to increase their mortgage lending further and with high credit ratings, they should easily be able to issue long-term debt. In addition, the securitisation market has significant growth potential, with PIF-backed Saudi Real Estate Refinance Company’s recent $2 billion international sukuk offering being oversubscribed six times and its announcement late last month that it had completed the Kingdom’s first mortgage-backed securities deal.

According to Abdullah Alhammad, CEO of REGA, the real estate and construction sectors contributed approximately 12% to Saudi GDP in 2024, a doubling of their 5.9% share in 2023. The new law could push this figure higher, and as investment flows in, the wider non-oil economy is also projected to accelerate, increasing overall GDP growth.

In the short to medium-term, the new law is likely to reinforce the demographic and economic dominance of Riyadh and Jeddah, respectively Saudi Arabia’s capital and largest Red Sea port, and in the longer term accelerate the development of the wider western seaboard (including projects connected to the NEOM metropolis) and other parts of the Kingdom.

Riyadh is undergoing one of the largest urban transformations in the Kingdom’s history. The capital’s masterplan envisions 340,000 new homes delivered by 2030, led by the ROSHN Group giga-project and the National Housing Company as well as 4.6 million square metres of new offices, 2.6 million square metres of new retail space, and almost 30,000 new hotel rooms. Within Riyadh, New Murabba is emerging as the world’s largest downtown project, covering an area of 19 square kilometres; Qiddiya is bringing together entertainment, sports, and creativity on an unprecedented scale; and on the city’s outskirts, the 14 square kilometre Diriyah project is an environmental masterpiece in the making.

In Jeddah, the Historic Jeddah Program is restoring heritage sites whilst Jeddah Central revitalises 5.7 million square metres of waterfront with a modern mixed-use destination that will include 17,000 homes.

In the northwest, NEOM will offer millions of residents a new model of urban life and is already shaping the Kingdom’s future with projects in clean energy, advanced industry, and sustainable living including Oxagon, planned as the world’s largest floating industrial hub.

The new law enhances Saudi Arabia’s appeal to global talent. It will now be more cost-effective to develop projects tailored to expats and foreign investors, and these are likely to be higher-margin. Resident expats alone currently comprise over 40% of the population of 35 million and home ownership and property investment, particularly if linked to residency status, will give them security and a stake in the Kingdom, likely extending their average stay and deepening their long-term commitment as its sunrise industries scale up.

The nature of Saudi Arabia’s expat population will also change as entrepreneurs and high-net-worth families from all over the world decide to relocate their businesses to the Kingdom. The demand for managerial and professional executive talent will surge as the new law stimulates ancillary service industries.

These developments and job opportunities will attract young Saudis. Indeed, Knight Frank estimates that over the past five years, some 50,000 young Saudi nationals have moved to Riyadh, where almost half of the new jobs created in recent years are located.

As Saudis, expats and foreign investors migrate to new urban developments, there will be greater impetus to the development of the Kingdom’s transport infrastructure, power grid, water and sewage systems, and education and healthcare infrastructure.

Not only does the new law enhance the attractiveness of the Kingdom's real estate market, it also creates new pathways for international investors to participate in local development and infrastructure projects. This includes areas such as data centres and digitalisation infrastructure, healthcare campuses, education hubs, logistics corridors, green industrial zones, transport and utilities. With each registered property, a stakeholder joins the broader vision of shared prosperity and nation-building.

Even outside the traditional hubs, the new law is rewriting the investment map. In Najran, Al-Baha, Al-Jawf, and Hail, regional governments will more easily be able to secure global capital and partnerships for cultural tourism projects, agri-tech zones, decentralised innovation campuses and more. Through legal inclusion, Vision 2030 will bring domestic prosperity far beyond giga- and mega-projects.

A new era for international investors in Saudi Arabia

Inside Saudi believes the liberalisation and continuing modernisation of the Kingdom's foreign ownership laws represent significant milestones in the country’s economic transformation.

For the first time since it was established almost a century ago, the property market of one of the most dynamic economies in the world will soon be accessible to global private and institutional capital, with regulatory safeguards in place to prevent an unwelcome bubble and ensure that capital inflows are aligned with national goals.

Saudi Arabia is not merely liberalising its real estate market: it is institutionalising it. The social contract is deepening: under Vision 2030, expats and foreign investors are not merely temporary guests but invited stakeholders. By opening property ownership, the Kingdom is inviting the world to partner in its progress.

Vision 2030 is now visibly unfolding across multiple sectors. The giga- and mega-projects that once sounded like futuristic dreams are now anchors of over $1 trillion in real estate and infrastructure projects and the new law will help to unlock development that is localised, inclusive, and durable.

As the law nears implementation in January 2026, REGA is finalising the necessary executive regulations, which will be published through the “Istitlaa” public consultation platform. This is an opportunity to engage the public, consult with the private sector, and develop a zoning framework that achieves Saudi Arabia’s goals of attracting capital and preserving affordability. We look forward to keeping you updated.

Summary: New real estate law

Note: Content for informational purposes only and not offered as legal or professional advice for any specific matter.