Wednesday, 01 October, 2025

Shaping the future of finance

How Money20/20 Middle East showed fintech’s centre of gravity is shifting

Shahad Alsubaie - Inside Saudi

Over three days, the event welcomed over 38,500 attendees, 450 global fintech brands and 1,050 investors, and facilitated almost 2,300 pre-scheduled investor-startup meetings and numerous partnership signings

From the moment the doors of Riyadh’s Exhibition and Convention Centre opened for Money20/20 Middle East, the city projected an energy that couldn’t be ignored. This was not just another fintech conference: it was the heartbeat of the industry, bringing together the world’s most influential voices in finance, technology and regulation to Saudi Arabia (KSA) to build the next era.

Over three days, the event welcomed over 38,500 attendees, 450 global fintech brands and 1,050 investors, making it the largest fintech gathering ever staged in the Middle East and the second largest globally. This represented a tripling of both global brand participation and investor attendance compared to last year’s 24Fintech event, placing KSA firmly at the centre of the global fintech conversation and Riyadh as a capital of global finance.

Hosted by KSA’s Financial Sector Development Program, Central Bank (SAMA), Capital Market Authority (CMA) and Insurance Authority, and co-organised by Fintech Saudi (a joint SAMA and CMA initiative) and Tahaluf (a joint venture between Informa, the Saudi Federation for Cyber Security, Programming and Drones, and the Events Investment Fund), sessions highlighted how digital transformation, regulatory foresight, inclusive innovation and cross-border partnerships are transforming financial services.

Here are the key insights, announcements and opportunities we took away.

Saudi Arabia’s Vision 2030 has made fintech a national priority

The first day featured uplifting remarks from KSA’s Finance Minister Mohammed Aljadaan, SAMA Governor Ayman Al-Sayari and CMA Chairman Mohammed Elkuwaiz.

The Finance Minister spoke of fintech and digital innovation not as an experiment but as a pillar of Vision 2030 and noted that the Saudi stock market is one of the fastest-growing globally, with total market capitalisation reaching $2.4T at the end of Q2 2025.

The CMA Chairman noted that whereas a decade ago retail investors accounted for over 80% of the total trading volume on the Saudi Exchange, it has now matured into forum of diverse investment perspectives, decreasing volatility “significantly”. In addition, AI is driving a profound transformation in financial supervision and the shift from a risk-based approach to advanced indicator-monitoring systems has improved monitoring by nearly 80%.

According to the SAMA Governor, fintech has established itself as one of KSA’s most attractive sectors for investors, with cumulative funds raised of around SAR 9B ($2.4B) and over 280 fintech firms operating in KSA currently, up from just over 80 at the end of 2022. He also noted that in the payments sector, electronic retail payments accounted for 79% of transactions by the end of 2024, quadruple the ratio a decade ago, exceeding Vision 2030’s 70% target two years ahead of schedule.

At the end of 2024, the fintech sector employed more than 11,000 people, and the 2030 goal is for it to create 18,000 jobs in total, with Saudi Arabia’s National Fintech Strategy aiming for 525 firms in the sector by 2030. Fintech Saudi is aiming for the sector’s GDP contribution to grow to SAR 13.3B ($3.5B) by 2030, with it already having contributed almost SAR 3.1B ($0.8B) in 2023.

The world is coming to KSA

Money20/20 Middle East facilitated 2,288 of pre-scheduled investor-startup meetings and numerous partnership signings, ensuring deal flow and long-term value creation well beyond the event.

Visa announced a new acceptance capability built specifically for KSA, a first-of-its-kind deployment. This initiative is closely aligned with national infrastructure and regulatory frameworks, aiming to expand digital commerce across KSA.

SAMA made two announcements regarding global payment platforms, confirming the integration into KSA’s national payment system, mada, of Google Pay and, from 2026, Alipay+. These significantly enhance the digital payment ecosystem and open the Saudi retail market to a vast network of international tourists and business travellers, demonstrating both global confidence and local ambition.

Limitless Payments, a new Riyadh-headquartered fintech investment vehicle, also debuted during the event. This brings together three fintech businesses: Xpence, the GCC’s leading B2B spend management platform; GC Partners, an international payments, foreign exchange, and treasury solutions specialist; and Numito, a multi-bank FX trading platform, into a joint stock company with an initial fund of $100M and more than $15B in existing gross transaction volume.

Building national, regional and global champions

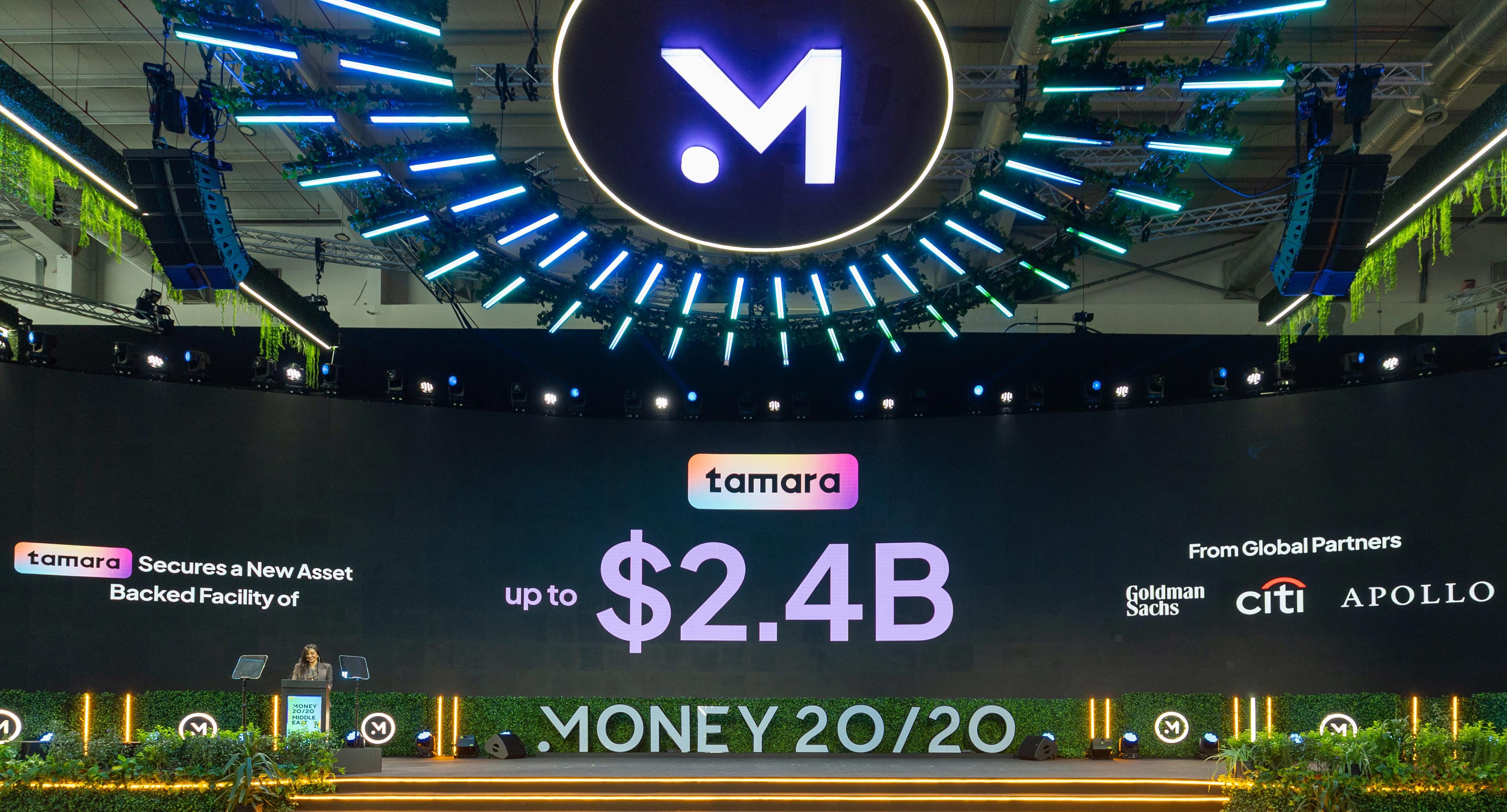

As proof that a Saudi homegrown fintech success story could stand shoulder-to-shoulder with the world’s most powerful financial players, buy-now-pay-later platform Tamara, KSA’s first unicorn, announced a new Shariah-compliant, asset-backed (loan-backed) financing facility of up to $2.4B from a consortium including Goldman Sachs, Citi and Apollo funds. This is intended to fuel its expansion into a financial super-app and upsizes a previous $500M arrangement, signalling investor confidence.

Elsewhere in the private markets, Saudi Technology Ventures, the largest independent technology venture capital fund in the Middle East, announced a partnership with Wamid, the technology arm of Saudi Tadawul Group (the parent of the Saudi Exchange), to launch KSA’s first private asset trading platform. This will drive liquidity to shareholders, investors and the broader market, and could unlock significant billions in untapped market potential.

In addition, SILQFi, the financial infrastructure arm of SILQ Group (a merger of KSA-based B2B marketplace Sary and Bangladesh’s ShopUp), announced the launch of Omni, a new platform designed to embed finance directly into the everyday operations of small and medium-sized enterprises (SMEs). This follows its acquisition of OXO, a key player in the Saudi point-of-sale (POS) market, and will integrates POS, procurement, payments, and real-time credit access into a single interface, thereby streamlining merchant workflows whilst improving access to capital.

Future opportunities: digital and grounded locally

If the first wave of fintech centred on broad applications, the second wave will need to focus on approaches that are more locally attuned.

Speedinvest’s Rana Abdel Latif identified three examples of market opportunities for the Middle East and large parts of Africa: the development of shariah-compliant products, catering to the underserved market of SMEs, and integrating fintech into various industries, such as the rising clean energy sector.

Sessions delved into the challenges and opportunities of designing digital-first solutions that are accessible, efficient and appealing whilst remaining true to their ethical principles, and how fintech is driving a new era of growth and relevance for Islamic finance in the global market. KSA recent addition to JP Morgan’s Government Bond Index – Emerging Markets watchlist reflects growing global confidence in the Saudi sukuk and debt capital market.

As regards the underserved, a session featuring Alaa AlMashhadi, Chief Business Development Officer at the Saudi Credit Bureau and Dr Khalid AlSharif, CEO of Abdul Latif Jameel United Finance explored how alternative data sources and open banking are reshaping assessments of creditworthiness. This has the potential to unlock financial access for gig workers, informal entrepreneurs, SMEs and others who may lack a conventional credit history but demonstrate financial reliability through other data points, and the discussion highlighted the role of technology in creating more inclusive and accurate risk assessment models.

Fintech: fertile ground for female and youth empowerment

Inclusive innovation was at the heart of the Money20/20 Middle East agenda, which proudly featured insights from current and future women leaders across the ecosystem. According to KSA’s Ministry of Communications and Information Technology, women make up 35% of the Saudi tech workforce, far above the European average rate of 22%.

As Huda Al Mousa, Country President for Saudi Arabia at payments infrastructure company PayTabs put it: “We’re at a truly historic inflection point. In Saudi Arabia, women are no longer just participating but helping lead fintech initiatives. The Vision 2030 agenda has opened doors for women across sectors, but fintech is especially fertile ground.” This was a sentiment was echoed by numerous others in the ecosystem throughout the event.

Both Al Mousa and Dr Basma Al Buhairan, Managing Director of the Centre for the Fourth Industrial Revolution Saudi Arabia, noted the emergence of targeted initiatives and partnerships empowering female entrepreneurs. This includes Blossom Accelerator, the first female-focused technology accelerator in KSA, which has launched an SME Empowerment Program in partnership with TikTok, bootcamps run by Fintech Saudi, and other incubators and accelerators who are actively recruiting women founders and fintech innovators.

Other panels emphasised the importance of the youth demographic. With over 60% of the Saudi population under the age of 30 and working lives lengthening, a number of speakers argued that embedding financial education into fintech products would be vital for Saudi Arabia’s fintech revolution.

Infrastructure and regulation to foster innovation and market access

Behind the scenes in KSA, major national infrastructure projects are progressing. The modernisation of the Real-Time Gross Settlement system will improve interoperability, accelerate settlements, and introduce advanced risk detection. The Central Electronic Clearing Center has adopted industry-leading standards and will soon deliver same-day cheque clearing, increasing the circulation of money in the economy and creating new payment use cases. Regulatory reforms such as clearing for securitisation and residential mortgage-backed securities will accelerate the growth of the debt capital markets, further deepening Saudi Arabia’s financial markets.

The CMA has continued to strengthen the regulatory foundations for the fintech sector’s growth. Through the CMA’s Fintech Lab, a sandbox mechanism, both domestic and international firms can pilot solutions under clear regulatory supervision, with a particular focus on securities crowdfunding, digital trading platforms and emerging technologies such AI and robo-advisory services. By the end of Q2 2025, 68 experimental permits had been granted and 50 companies were registered.

In parallel, the CMA’s efforts have encouraged the establishment of venture capital funds dedicated to the fintech sector to ensure that new entrants benefit from both oversight and capital.

To support the growth of the asset management industry, the CMA has introduced Saudi Arabia’s first omnibus system, allowing capital market institutions to pool assets into a single account and improving asset management for smaller clients. KSA has also launched the most significant pension reform in Saudi history, which will raise the retirement age and increase contribution rates.

In addition, KSA is building an offshore licensing regime and preparing to roll out a flexible funds framework, further enhancing its global competitiveness. Such measures position Saudi capital markets not only as regional leaders but as active players on the global financial stage.

Global collaboration is key

The presence of major international regulators highlighted the role of Money20/20 Middle East as a forum for dialogue between innovators, investors and policymakers globally. High-profile speakers included acting chair of the US Commodity Futures Trading Commission Caroline Pham, General Director of the Agency for Digital Italy Mario Nobile, and the UK Financial Conduct Authority’s Head of Innovation Colin Payne.

Al-Sayari, the SAMA Governor, cautioned in his opening remarks against viewing fintech as a purely domestic story. The global nature of finance means opportunities and risks flow across borders instantly. Stablecoins, tokenisation and artificial intelligence are frontier technologies that require cross-jurisdictional collaboration and SAMA is actively working with international regulators to harmonise standards, manage risks, and ensure that innovation scales safely.

“Collaboration,” Al-Sayari stressed, “is the foundation of a safe, inclusive, and innovative global financial system.”

Saudi Arabia: Shaping the future

For KSA, with its over $1T economy, young and digital-native population with high disposable incomes, national agenda built on digitalisation and fintech as a Vision 2030 priority, hosting Money20/20 Middle East represented validation. For the Middle East, the event anchored Riyadh as the regional epicentre of a seismic shift. And for the world, it sent an unmistakable signal: the region is not a passive consumer or playing catch-up with the West but charting a distinctive path forward, with KSA as producer, a leader, and a shaper of the future.

Ahmad Ghandour, Regional Vice President for the multinational fintech Backbase, summarised the industry’s progress across much of the Middle East and North Africa: “In terms of digital finance, we are not an emerging region, but rather are ahead of the curve now.”

The global early-stage investment community has taken notice. Despite the relatively slow pace of venture investment and exits globally during the first half of 2025, KSA saw record levels of activity and exits are becoming frequent enough for capital to be recycled back into the system. Top-tier global venture investors have entered KSA sooner than expected, with Sequoia and General amongst recent entrants.

As the final sessions drew to a close and the crowds began to disperse, there was a collective recognition that this was not an ending, but a beginning. Vision 2030’s fintech pillar is the story of a nation refusing to wait for the future but instead choosing to build it, host it, and lead it. It is the story of homegrown successes standing tall beside global titans, of underserved and underrepresented groups discovering new possibilities. And as Governor Al-Sayari reminded the audience, it is also the story of collaboration between regulators, innovators, and global partners ensuring that the fintech revolution is safe, inclusive, and enduring.

We look forward to keeping you updated.

Images used with support from Money20/20 Middle East and Tahaluf.